Things they never tell first time Parents!

THE THINGS THEY NEVER TELL FIRST-TIME PARENTS!!

Children are expensive ! Its like having a little automatic ATM card and you’re the machine . When my son was born, we received about 15 baby blankets, three hooded towels and countless words of wisdom about sleeping schedules. But no one mentioned the long-term financial implications of our happy event or how to budget for our growing family.

New research reveals that the average cost of raising a child until their 21st birthday in Ireland can be as much as €105,321,

There are three really important financial moves every new parent should consider. Devoting time to these three things during the first year of your baby’s life may seem like a challenge — especially when you’re sleep deprived !!

1. APPOINT A GUARDIAN AND AN EXECUTOR

Our own mortality is the last thing we like to spend time thinking about after bringing a new life into the world. You’re not alone. Many people put off creating a will for just that reason,. But a will is critical for parents of children because it allows you to name the person you trust to take care of your child if both you and your fellow sleep deprived parent die should die.

2. GET YOUR INSURANCE IN ORDER

If you have children you need life insurance .

• In plain English, it creates an immediate source of income for your family when you die. A stay-at-home-parent should earn around €60,000 per year for all the work they do, be it

• taxi driver

• counsellor

• chef

• cleaner

• gardener

Hang on a minute I am owed loads from those early years ! Who do I complain to ???

When you die, your income stops but your family will still depend on that income. Life insurance leaves a lump sum of money that your family can dip into to replace your income.

You don’t have to insure enormous amounts of money ,but please insure some . After all you cant eat a house !

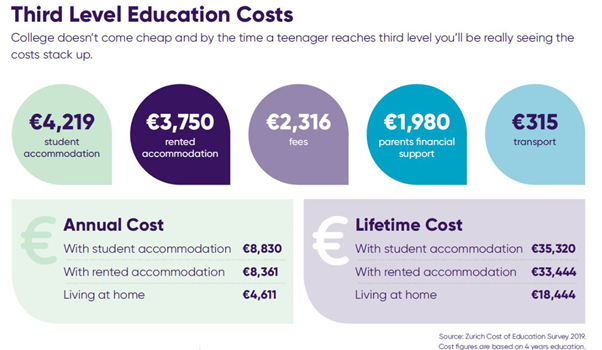

3.DON’T POSTPONE COLLEGE PLANNING

Start now ! I have teens trust me start now !!!

The main benefit of saving for your children’s education is that you will have a nest egg stashed aside to pay for the ever increasing third-level education costs. It is estimated that it takes close to €10000 per year to pay for a child’s third-level education. The average college course is 4 years so, roughly speaking, it can cost up to €40000 to put each child through college.

‘A recent study undertaken by Zurich in 2020 indicated that 41% of households got into debt as a consequence of their children going to college’

EEEEKKKK I’m going looking for my back pay now !

Book a consult we are sound !