What’s the Difference Between Health Insurance and Income Protection?

I want some kind of health cover in case I am ill. I’ve come across Health Insurance, Income Protection and Permanent Health Insurance – what is the difference?

This blog is inspired by a client who asked this very question during the week in a nutshell Health Insurance pays the medical bills Income Protection pays you.

Deciding on which type of Insurance cover is right for you can be a mine field A lot of people only look at these things when they get a scare and unfortunately that is often too late when it comes to insurance products.

So Let’s look at Health Insurance first.

If you have a niggling health worry, private health insurance provides you with fast access (well it’s supposed to) to private healthcare. But while private health insurance might take a load off your mind, it doesn’t come cheap. Exactly what is covered by private health insurance will vary between providers and the level of cover you choose. However you can typically expect the following with comprehensive private health insurance:

- Private consultations with specialist doctors.

- In-patient treatment, including surgery.

- Out-patient services including scans, tests and x-rays.

- Physiotherapy for problems such as back pain or sporting injuries.

- Access to round-the-clock medical helplines and virtual GP appointments

Private healthcare prices can be eye-watering. Costs can vary substantially though and varies according to factors such as your age and if you smoke A significant driver of cost is the level of cover you choose too as you will see when you are comparing private health insurance plans. Also bear in mind it will cost more if you want family private health insurance with a partner and children included .It’s a personal choice and very often an emotional one its down to peace of mind and budget.

Now Let’s look at Income Protection/Phi

First question we are often asked is Do I need it?

My answer is always well do you need your income? If you don’t then you probably don’t need it and you can stop reading now!

If however you are like me dependent on the money that lands in your bank account every month and you don’t have that protected well I have one question for you. Are you mad??If you don’t have income protection insurance, you’re living with the risk of being unable to keep up with the cost of living if you lose your income through illness or injury.

Lots of people would face financial hardship, straight away or over time, if they lost their income for medical reasons. This is because so many of us do have financial commitments, like paying for rent/mortgage, food and bills, The bills don’t care if your too sick to go to work they will keep popping into the inbox.

Many of us also have partners or children who rely on our income too – so it’s easy to see how a missing income can end up having significant, long-lasting financial consequences

The question to ask yourself is: if you were too unwell to work, would you be able to keep up with the cost of life? Whatever you answer to this question will help you make your decision.

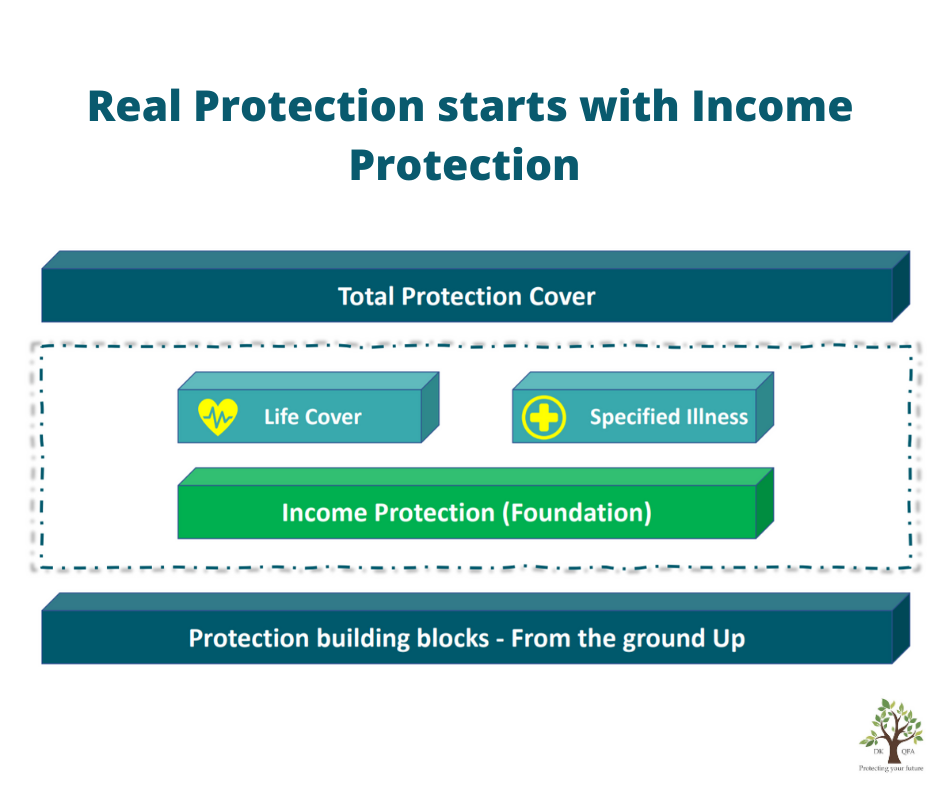

So what is Income Protection?

If you can’t work due to illness or injury, an Income Protection policy will provide you with a regular income. Income Protection is available to those working more than 16 hours per week in paid employment or the self-employed. Even if you make a claim and then go back to work, you’re still covered in case you ever need it again. Policies commonly pay out up to 75% of your gross (pre-tax) monthly earnings. You will get tax relief at your own rate of tax on the premium.

What does it cover?

INCOME PROTECTION will cover you for ANY accident or illness that stops you from working. Once your doctor says you are unfit to work then you have a claim .Key word here is ANY!

Does it cover Redundancy? No, income protection insurance only covers you for loss of earnings that are brought about by medical reasons – mental or physical, illness or injury

Reasons to choose Income Protection

• You’re self‑employed so don’t qualify to receive the State Illness Benefit

• You’re working more than 16 hours a week in paid employment and rely on your income to support your outgoings

• Your current sick leave benefits would not be sufficient

• The State Illness Benefit is not enough to support you and your family

This is why income protection is the most important EVERY working person can buy. You can contact us here info@davidkelleher.ie