Living Benefits

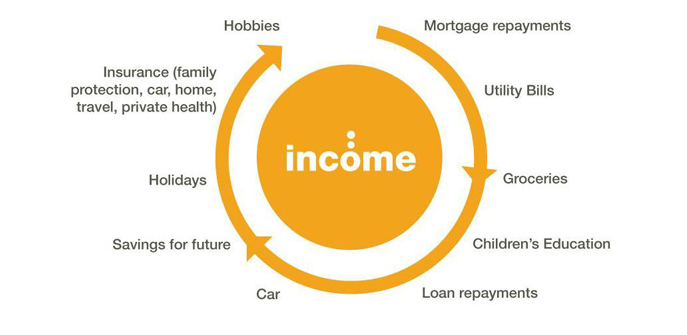

If you were diagnosed with an illness tomorrow, how would you cope? How would your family cope? Aside from the emotional strain, there is a financial strain to also think about. Imagine the consequences this would have on your lifestyle if you had to leave your job due to an illness.

- Could you pay the mortgage?

- Household bills?

- Send the kids to school?

- How would your family survive if part or all of the income suddenly came to a halt?

Life insurance offers much more than a financial benefit, it offers peace of mind. What many people don’t know is that life cover offers many other benefits that can help in difficult times. Some of these benefits are even included in your life insurance policy at no extra cost.

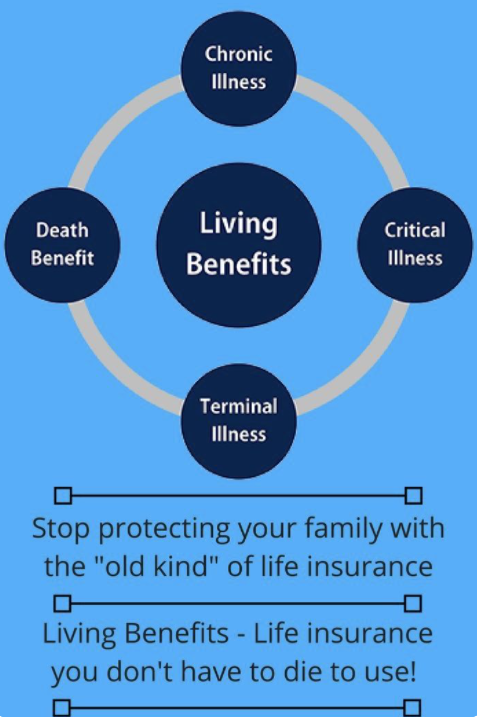

LIFE INSURANCE LIVING BENEFITS

Specified Illness Cover

This cover is designed to aid policy holders who have been diagnosed with one of the many serious illnesses listed in the life company’s policy guide. This type of policy issues a pre agreed amount of money that can be then be used in order to cover the costs of recovery and allows the policy holder to continue to meet their financial commitments. I much prefer Income Protection over this one

Cancer Cover

Cancer cover policy holders, if diagnosed with a cancer that is listed on the insurers list, will be paid a lump sum in order to help with medical costs and any financial commitments the policy holder may have. This type of cover can be extremely beneficial as it can remove the uncertainty over your finances and will allow the policy holder to concentrate fully on getting better. It is also more affordable than serious illness cover.

Terminal Illness Cover

Although not something we like to think about, being diagnosed with a terminal illness will completely change a person’s life. For this reason if you were to be diagnosed with a terminal illness, and have less than 12 months to live, your life insurer will often pay out the death benefit early as an extra financial support for you and your family. This may be included free of charge on many life insurance policies.

Accident and Broken Bones Cover

Just because you are in hospital doesn’t mean the bills stop coming in.

Broken bones cover is a benefit that many life companies provide that does exactly what it says on the tin; it pays out a small lump sum if you break a major bone listed on the policy.

Personal accident insurance is cover that protects you in the event that you suffer an injury, as a result of an accident, which prevents you from working. The benefit of having personal accident insurance is that if you are unable to work due to an accident, then you and your family will receive some financial support.

Personal accident and income protection insurance are designed to replace your income if you’re temporarily unfit to work. However, personal accident insurance (sometimes referred to as personal injury insurance) only covers you for accidental injuries, whereas income protection can pay you if you’re sick or injured.

Accident cover covers you for up to 52 weeks

Income Protection

If one of you die sure the mortgage might get paid off, but what about the loss of that persons income? How would that affect the household? Your kids future? The bills that still have to be paid!

Although this is not an additional option on a Life policy it is a standalone cover, Income protection is an essential protection policy which provides the policy holder with a steady income if they were to become unwell or unable to work. The great thing about this cover is that the life company will continue to pay this until you are able to return to work again as confirmed by your doctor, there is no time frame on payment once you are signed off unable to work by your GP. You can also claim tax relief on your premiums at your marginal rate. The benefit is defined by how much you insure weekly from the outset (max 75% of your gross earnings). Also it covers you for ANY accident or injury that puts you out of work( excluding pre existing)

If any of these benefits make you think right now then chances are they are important to you and you should look at applying for them. Here at David Kelleher Insurances our Life team will take you through all the benefits associated with protecting your future and allow you to make an informed decision.

Contact us below if you would like to speak to an advisor who can give you the peace of mind you have never had before. Also we are sound and don’t charge fees😊

All policies are subject to full underwriting and medical history will be the basis for acceptance, exclusions or loading