AVC’s Time to take away the Mystery

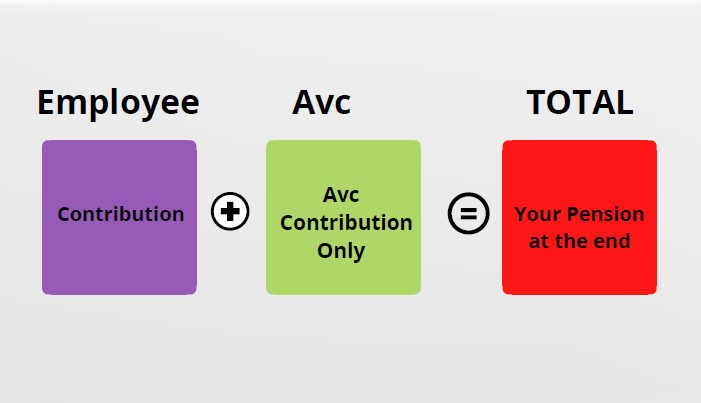

Additional Voluntary Contributions (AVCs)

An AVC is a smart, tax-efficient way to save for extra income in retirement.

It’s designed to help you top up your pension and enjoy more flexibility and financial security when you stop working.

Additional Voluntary Contributions.

An Additional Voluntary Contribution (AVC) is a tax-efficient way to fund extra income when you retire. At retirement, you can use the money invested in an AVC to buy the additional pension benefits you want, subject to Revenue rules.

Why Consider an AVC?

AVCs stand out from other savings because they offer significant tax benefits:

- Maximize your tax-free lump sum at retirement.

- Boost your pension income for a more comfortable retirement.

- Enjoy tax relief on your contributions.

- Benefit from tax-free investment growth.

How Does Tax Relief Work?

When you pay into an AVC, you get tax relief at your highest rate:

- 40% taxpayer: Save €40 in tax for every €100 contributed.

- 20% taxpayer: Save €20 in tax for every €100 contributed.

How Much Can You Contribute?

The older you are, the more you can contribute and claim tax relief

- Under 30: 15% of income

- Age 30-39: 20% of income

- Age 40-49: 25% of income

- Age 50-54: 30% of income

- Age 55-59: 35% of income

- Age 60+: 40% of income

What Happens at Retirement?

At retirement, your AVC can be used to:

- Take a tax-free lump sum (up to €200k).

- Buy a pension (annuity) for guaranteed income.

- Invest in an Approved Retirement Fund (ARF).

- Take a taxable lump sum.

The best option for you depends on your individual circumstances and Revenue rules.

Buying Back Years of Service

If you’ve built up savings in an AVC, you might be able to transfer them to your employer to buy back years of service or notional years—an efficient way to boost your main pension benefits.

Plan Ahead

Retirement planning is most effective when done early. If you have an AVC or are thinking about setting one up, we can help you understand your options and make the most of your savings.

Book a Call Today We’re experts in helping you use AVCs to supplement your pension and create a retirement plan that works for you.

Investments can fall as well as rise. Past performance is no guarantee of future results.