What Is Mortgage Protection?

We all value our home as a place to relax, a sanctuary from day‑to‑day life, a base for our families and a home to our children. In these Covid times its also our office our gym and so many other things.

Like many people, your mortgage is probably your largest financial responsibility. Of course, there’s always a worry that should you die or become seriously ill, your family may have difficulty meeting this large liability.

So how do we protect our castle without paying the amount it costs to buy one. Simples Decreasing term mortgage protection. We are usually sold mortgage protection when we take out our mortgage and the banks are great at railroading you into buying their product because you must have mortgage protection to get a mortgage!

But what they don’t tell you is that you don’t actually have to buy a mortgage protection plan from your bank.

This is where you need to be strong my friend and say No!!

Then you come to us and we will sort you out with a policy that protects you and not the banks, they will be grand trust me.

Time for lesson number one. Pay attention now.

So How does it work. For example, you borrow €200,000 over 30 years.

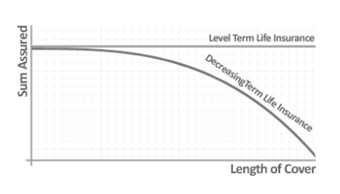

You start today at €200k and as the balance of your mortgage comes down so does your mortgage protection (don’t worry it decreases at a slower rate than your mortgage) so at the end of 30 years both will be nil. Happy days mortgage paid off!

The death benefit (life cover amount) reduces down in line with the mortgage while your monthly cost remains fixed for the term. These policies are extremely cost effective for a mortgage because as you get older and more costly to ensure the benefit decreasing means you get a much cheaper policy from the get-go.

This will then allow you more financial freedom to protect the inhabitants of the castle not the banks!

More good news if you already have one of these policies more than likely it’s a joint life contract which means it only pays out on the first death, now days with the magic of new inventions you can get dual life mortgage cover for much the same price! So, double the cover for the same cost this is a no brainer in our books.

Mortgages take a while to pay off, why would you want to give the bank more than the legal obligation of a basic mortgage policy. Why overpay on such a lengthy contract. Saving €10 a month by shopping around could see you save €3600 over the term of the mortgage.

In some cases, Level Life Term Insurance (that’s next week’s lesson) might be a better choice for you than Reducing Term Life Insurance. This depends on your needs.

If you have already bought your mortgage protection and life insurance through the bank never fear. Switching is easy and free.

Why Speak to Us…

We won’t treat you like a number, we all deserve more when it comes to protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

- We are independent and impartial

We are not tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs. - We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you are going direct yourself. - You’ll speak to a dedicated expert from start to finish

You will speak to one of us with a direct telephone and email. You can even what’s app if you’re a texter. No more automated machines and no more being sent from Billy to Jack and back to Billy again. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service. - Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service, we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities. - Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.

Now what? Hit contact us and we will take it from there.